Introduction: The Background of NRI Remittances to India

Millions of NRIs send money home every year to help out their parents, invest in assets or just stay connected financially with India. These remittances are a significant source of income for many Indian families, and also benefit the country’s economy. But more often than not NRIs find themselves in a fix about whether the money they remit is taxable in India or if there are any reporting obligations. GSCCA is platform to guide NRIs in this regard and make sure that they are well informed about the rules so that can send money without worrying unnecessarily. Knowing the tax treatment on remittances is straightforward for Indians and helps in overall financial planning.

Is NRI Remittance to India Taxable?

The good news: money sent to India from abroad isn’t treated as taxable income for the recipient. As and when an NRI remits money to parents, spouse, children or any other relative (other than disabled relatives), such amount is in the nature of gift or transfer and cannot be included under the head income. Indian tax laws exempt money received from an NR as long as such person is a relative under the provisions of the Income Tax Act. Even when support payments are received, they do not count as income and no tax obligation exists. This is why remittances happen to be a secure and tax-free option for NRIs to support their family back in India.

Who Counts as a Relative Under the Tax Laws?

The giving or transfer of a gift is subject to taxation by the relation, and the classification as taxable or not depends on if the sender is a relative. The term encompasses parents, brothers and sisters, spouse, children (including adopted children), grandchildren, grandparents or members of any other descending line with such ascriptions. Whatever an NRI remits to any of these individuals, it is not taxable irrespective of the amount. On the other hand, non-relatives’ presents can be taxable if they are more than the amount provided for by tax legislation. GSCCA is here to protect knowledge and correct labeling, while providing the right information so families do not have problems when investigated or re-evaluated at a later time.

Documentation Needed for Safe Remittances

Remittances are tax-free, but you should keep valid records. The applicant would be well advised to make a copy of the remittance receipt, bank statements and evidence of relationship element if it is needed. These materials can help demonstrate that what is received is not income but rather a transfer within the family. Instead, NRIs who use official routes such as bank transfers or NRO/NRE accounts will naturally generate an audit trail, adding another layer of security. GSCCA suggests the opposite for NRIs that they should always keep things transparent in terms of banking affairs to avoid any conflicts with compliance issues or further purchasing of property from remittances.

Remitting Funds via NRE/NRO/FCNR Accounts

There are a variety of banking accounts NRIs can choose from to send money to India. Hence money remitted from an NRE or FCNR account is fully repatriable and tax free, as such accounts contains earnings originated outside India. But money in an NRO account is covered by TDS rules on interest earned. When NRIs send money from abroad into an Indian account of a family member, they are doing a straightforward remittance and there is no tax implication in that case.

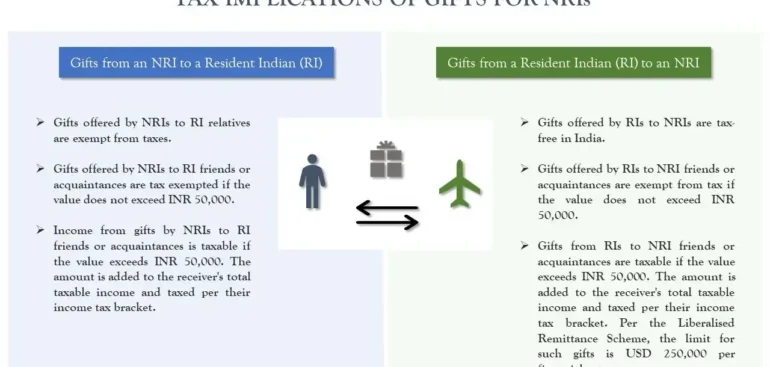

Gift Tax Laws on Sending Money for NRIs

The gift tax laws in India are simple. There is an exemption on gift from relatives whether the amount is small or large, both residents and NRIs have this cover. If an NRI sends money to a parent or child, this is classified as a tax-free gift. In the case of sending money to a non-relative, they added: “You may have to pay tax on the gift if your estate has received value in excess of applicable allowances when you die and such gifts are made within seven years of death.” If applicable, it is necessary to the Badge receiver to make the proper classification of this transfer within his tax declaration. GSCCA helps families report correctly, to stay in compliance and not make mistakes.

Do Any Foreign Countries Tax Remittances?

As the receiver in India is not taxed on remittances, some of the NRIs may have to comply with reporting obligations to be adhered to in their country of residence. A lot of countries require their citizens to declare foreign transfers exceeding a threshold for regulatory purposes. These are often compliance requirements and not taxes. You should also know that sending money from India to abroad may incur LRS guidelines but there is no such restriction for receiving funds in India from an NRI. GSCCA guidance by country of residence The GSCCA provides some direction by looking at the NRI’s country of residence to establish complete understanding on international reporting.

Charging of Income on Remittances

No, it is not taxable to ‘receive’ money However the interest whether direct or indirect (in form of investment etc) would be considered as an income and hence taxable in India. For instance, if an NRI sends money to a parent and the parent invests it in a fixed deposit, then the interest earned on the FD that will be taxed according to the income bracket of the parent. Also, using remitted money to buy property will lead to rental income or capital gains from the property being taxable too.

Restrictions on the Amount of Money That Can Be Sent__$0016

There is no maximum limit for a non-repatriable NRI to send money back to the country – be it towards family maintenance or otherwise. India embraces the foreign remittances and Reserve Bank of India permits NRIs to remit the funds freely through official banking networks. But, the money has to be clean and trackable. On very rare occasions, exceptionally large transfers could draw questions under anti-money laundering laws, which is why transparency is crucial. GSCCA makes it certain that paper work is powerful enough to resolve all the compliance questions.

Practical Scenarios for NRI Remittances

Majority of IGWs send money to maintain their parents, educating the children, assist in family events and medical purposes. Still others wire money to invest in real estate or launch a business in India. Each case also has various financial consequences, particularly when the returned money earns future income. Financial planning, appropriate use of accounts and documentation correctly by NRIs can ensure that they use money efficiently without smacking into tax issues. GSCCA is helping the NRIs to manage these and further situations with 3Es i.e. Easy, Expertise and E-visibility.

In short, remittances are safe, easy and tax-fee transfers for families.

Giving money to family members in India is one of the easiest and tax-smart money transfers that NRIs do. The remittance is unsentimental, non-taxable and no-strings, with no financial risk when transmitted by legitimate means. Documentation, Relationship classification and Taxation of proceeds to be used in future is what matters. GSCCA makes all of this simpler and worry-free for NRIs and their families by keeping the Indian tax laws in complete perspective.