Digital Bookkeeping Or Traditional Accounting: What Suits Modern SMEs More?

Small and medium business is growing by leaps & bounds in India. Gone are the days when all one had to do was keep record of purchase and sale for accounting, with more and more adherence requirements, digital payments systems, online taxation system etc basic accountancy is no longer enough. SMEs today have to make a choice between traditional accounting and adopting digital bookkeeping for efficiency and growth.

Not only is GSCCA an entrepreneurial company with multi-sector business expertise, we also appreciate how the correct accounting system can have a direct impact on profitability, compliance and decision making. This blog looks at the major differences between digital bookkeeping and traditional accounting to support SME’s in its selection process.

Conventional Accounting and its usage in Small Businesselpers

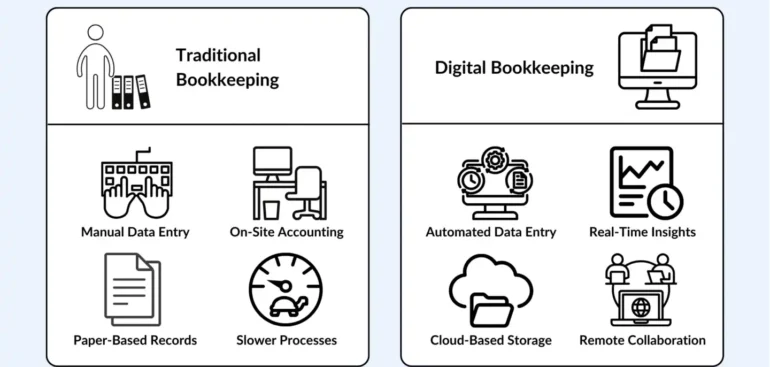

Conventional accounting: This is manual bookkeeping, and it’s – frustratingly – the way most people still do things. Most small businesses continue to maintain handwritten ledgers, cash book and invoice filing is still done manually in many places.”

For business owners who’ve been using index methods for years, this method provides familiarity and control. To very small businesses with low volume of transactions, manual accounting may seem sensible and possible. But it relies a lot on human precision and constant monitoring.

But with increase in business volume, it is difficult to continue posting records manually as it becomes very hard to maintain them.

Digital Bookkeeping Explained for SMEs

Digital bookkeeping is the electronic management of financial data using accounting softwares and cloud based platforms. Registrations are digital, calculations executed automatically, and reporting immediate.

With the digital record-keeping, SMEs will be able to record transactions (i.e. income and expenses), pay bills, create and send invoices; generate reports and monitor GST turnover and bank transactions at any given time of operations. “Software such as Tally, Zoho Books and cloud accounting solutions are gaining mass adoption amongst businesses and professionals”

GSCCAadvises SMEs to go digital with bookkeeping Globally, Software with robust Audit Features.

ACCURACY OF FINANCIAL RECORDS AND REPORTS.

When recording, there is also an increased popularity of human error when using manual accounting. Even minor errors can result in incorrect financial reports or tax returns, leading to compliance problems.

Computerized accounting provides greater precision, by automating the process of calculations and validations. Tax rules are correctly handled by accounting software, and all transactions have audit trails. And that means trustworthy numbers and less reliance on manual verification.

They also enable SMEs to be more transparent and trustworthy regarding their bank, investor and taxation affairs.

Time Savings and Business Efficiency

Conventional accounting demands a lot of time for entries recording, account reconciling, and generating reports. Financial updates sometimes come late to business owners, making it harder for them to act immediately.

Automated day-to-day accounting will save time with digital bookkeeping. Statements such as profit and loss, balance sheet, or cash flow information can be accessed at any time. This helps SME owners to concentrate on growth, sales and operations planning.

GSCCA considers time element as the greatest, among several benefits of digital accounting for the growing businesses.

Impact on Small and Medium size Businesses (SMEs)

At the onset, traditional accounting appears cheaper as it does not have software costs. Yet manual solutions can demand more people, corrections and follow-ups to pump up indirect costs.

While digital bookkeeping requires an initial outlay for software, over the long run it’s cheaper as it will reduce errors, save time and increase efficiency. As SMEs expand, digital systems scale readily with less associated overhead.

Digital bookkeeping is a greener choice for companies with imminent growth.

Digital Compliance and the Future of Tax Management

The taxation system in India has been digitalising gradually with GST returns, e-invoicing, TDS filings and online income tax compliance. Traditional accounting procedures cannot cope with this demand, it is too difficult and too dangerous.

Digital bookkeeping Software automatically updates with regulatory reforms and facilitates compliance. EasemyGST Reconcillation Fill and Lodgement of Retruns and Statutory Reports Accurately and On Time.

@ GSCCA supports small businesses to stay legal and penalty free by having compliant accounting systems.

Data Safety and Record Preservation

Paper documents are a staple in accounting but they can be destroyed, stolen or misplaced. It�s very hard to be, in these situations, able to get the financial stuff back.�

Bookkeeping software provides stronger data security with backups, password protection and cloud storage. Data can also be recovered quickly, even in the event of a disaster.

But for SMEs handling this kind of sensitive financial data nothing beats the reassurance from digital data security.”

Financial Insights for Smarter Decisions

Conventional accounting is primarily about record keeping and provides little analytic perspective. Reports can be very slow to produce and therefore not particularly useful for decision making.

You can see what’s going on as it happens. SME owners can track their income, costs, cash flow and receivables with a single click. Such insights are also valuable for budgeting, forecasting and strategic planning.

GSCCA is committed to the idea that knowledge drives success.

The Right Accounting System for SME’s

Very small businesses with only a few transactions may still be happy with traditional accounting. But for the vast majority of SMEs, digital bookkeeping, makes them more in control, more compliant and better able to grow their business.

Companies that implement digital accounting solutions will be more competitive and well-prepared for future changes to regulations and technology.

How SMEs Benefit from GSCCA

GSCCA delivers expert advice on accounting, tax and compliance requirements for SME businesses. Through a blend of accounting knowledge and technology solutions, GSCCA enables small businesses to manage their finances with ease and confidence.

Every business goes through new system implementation or an upgrade to systems set up for operational efficiency, whether coming from manual accounting or the paper work process.

Conclusion

Accounting in the cloud or on the computer deskDigital bookkeeping and manual accounting both have their place, but what small business accountants room is there for today’s digital solutions. With precise, effective and compliant support, and direct insights for businesses – digital bookkeeping enables the growing business to thrive.

With professional assistance provided by GSCCA, SMEs can choose the best accounting system and establish the financial grounding for tomorrow.