Introduction

GST (Goods and Services Tax) has been India’s biggest tax reform, and the introduction of this new system of indirect taxation is a movement to incorporate simple, effective, quick and little compliance burden. Monthly Return Filing Reconciliation There are lots of challenges that SMEs have to face in maintaining their day-to-day operations like handling regular notices, different updates about GST and much more. There are repercussions even for a small mistake which may result in penalty, restricted ITC claimed or an error of working capital cycle. Small businesses operate with such advisers and accordingly manage GST effectively thereby, reducing risk of non-compliances. With professional assistance, companies can look to expand while ensuring they meet their GST obligations in full.

Common mistakes in GST Filing that impacts SMEs

Improper or late GST return filing is one of the major problems which SMEs encounter. A missed filing deadline or errant entry can unleash a cascading series of issues. Penalties and interest when filing late would add financial strain on small businesses. Mistakes in GSTR-1 or GSTR-3B can lead to a discrepancy between the vendor and buyer’s data. This anomaly has an implication on the input tax credit and SMEs could be deprived of their eligible credits due to errant filing. Normally this happens because the user does not understand the GST or made manual errors.

Problems in Availing Input Tax Credit

To sustain the healthy cash flow, ITC is crucial. But SME’s often face challenges in availing ITC accurately because of credit cum duty mismatch in invoices, non filing by vendors or incomplete documentation. Input tax credit is available only if the vendors also file their returns on time and, as many SMEs lack a good system of vendor’s credit vetting and follow-ups in place. Wrong ITC bring notices whereas missed ITC leads to money loss. An Accountant ensures that reconciliation is done carefully and that any incorrect claims are not made which could lead to penalties.

However You Slice It (the Strange Ways You Are Entitled to Refund of Excess Input Tax Credits and the Imposition of Interest)

Reconciliation is one of the most challenging aspects within GST compliance for SMEs. Purchase registers, GSTR-2B and sales ledgers need to be reconciled perfectly every month. Most small businesses lack automation or trained resources to handle this. Incorrect reconciliation will result in annual returns being incorrect and impact on the accuracy of financial statements. If the reconciliation isn’t done periodically, errors accumulate and are harder to resolve at year’s end. It’s all over Expertise and As soon as you get into the system is to be checking systematically, which a CA just continues doing.

Ignorance of Rule Changes in GST

GST laws are dynamic, and for SMEs it is always a struggle to keep pace with alerts, amendments, portal modifications. Failure to have the latest version of an update can result in improper filings, incorrect classing and failure to satisfy new requirements. This unawareness affects the ITC eligibility, deadline for return filing, e-invoicing rules and so on. ET finds out if there is a way for businesses to keep up with the latest in GST payments. It provides SMEs guidance ‘at the right time’, thus avoiding mistakes that arise due to obsolete information.

Challenges Of GST Notices & Department Queries

A lot of SMEs freak out when they get a GST notice since they have no idea about technical language or even why the notice was sent. Shoes notices connected with differences/ Excess ITC / short payment / Kotaku/non-reconciliation are to be replied within given timeline. Incorrect answers can result in penalties or legal trouble. CA goes through above notice, finds out reason behind the same and prepares a correct reply and all necessary documents. This provides the business with a level of indemnification whilst ensuring compliance.

challenges with e-invoicing and digitized documents

As obligations for e-invoicing become more widespread, a lot of smaller businesses are unclear whether their business requires to comply or not. And even if they qualify, many companies have difficulties in implementing e-invoicing systems and integrating them into their billing software while keeping correct digital records. Lack of e-invoices or incorrect preparation cause ITC related and compliance-related problems. A CA guides SMEs to choose the right e-invoicing process, comply with essential laws and store records which can support audits and assessments.

How a CA Supports SMEs to Remain 100 % GST Compliant.

Professional expertise, precision and methodical management is what a CA brings on board for the GST. They facilitate on time filing of GSTR-1, GSTR-3B, annual returns & reconciliations. You also manage purchase data, vendor compliance and ITC eligibility to ensure cash flow optimization. They catch mistakes early so they can correct them before filing and avoid penalties in the future. A CA is an advisor for the long term and establishes systems, automates compliance processes and educates the business about good practices. When SMEs are steered lightly from the start, doom-and-gloom mistakes are avoided and overall financial discipline is enhanced.

Increasing Your Cash & Reducing Your Tax With Elite Advice

One of the major benefits of CAs being in charge of GST will be better financial efficiency. By filing correct ITC claims and eliminating any undue tax payments, the CA enhances your business’ cash flow. They’ll also advise SMEs on tax planning, applicable exemptions, benefits of composition scheme, turn-over limits and other industry-specific provisions. The result is the business pays exactly what it needs and cuts out over-paid tax. With richer planning, SMEs can control the operations with less worry on money front.

How GSCCA & Associates Aids The Small and Medium Enterprises With GST

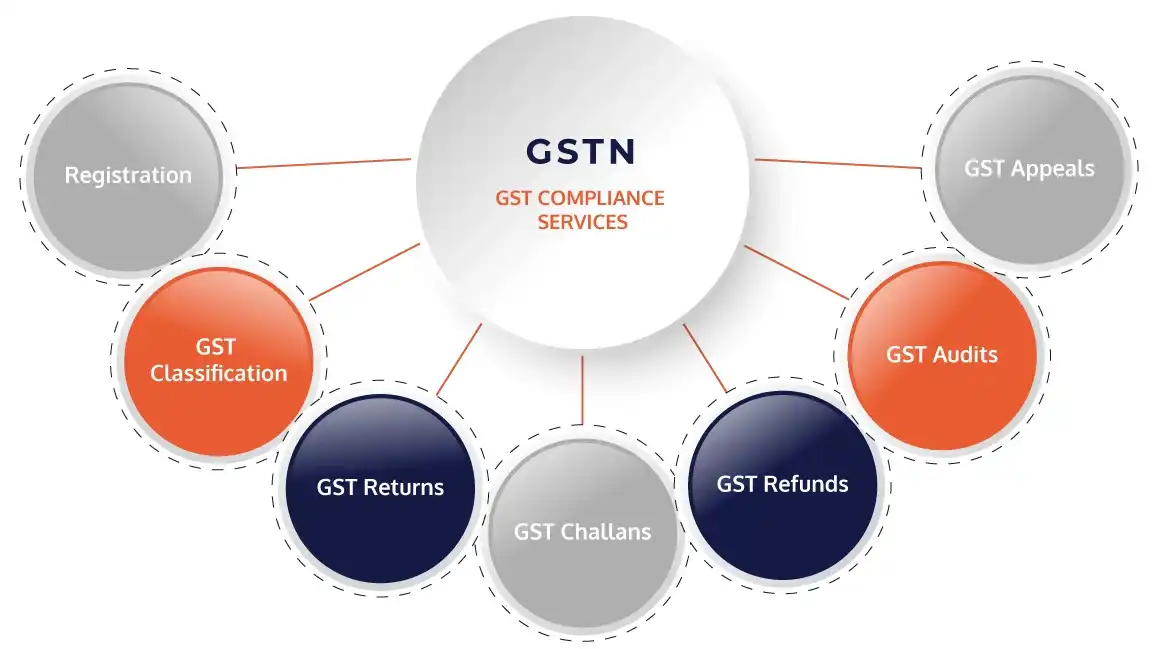

GSCCA& Associates specializes in small and medium business GST consulting, filing, compliance support. The services offered by it include end-to-end packages such as monthly return, ITC reconciliation, e-invoicing setup, GST Registration, annual return preparation and notice handling. Companies get advice customized to their sector, pain points and financial ambitions. GSCCA ensures that each SME remains 100% compliant with less exposure to risks of tax and maximum simplified operations.

Conclusion

GST Efficiency may appear to be difficult for SMEs, but with professional help it can be set correct and error-proof. It is common to be able to eliminate these kind of errors once you have the right systems and advice in place. A CA not only helps avoid fines, it also aids in better management of cash flow and operations. With the right partner such as GSCCA & Associates, small businesses can concentrate on growing and remain assured and compliant under GST law.